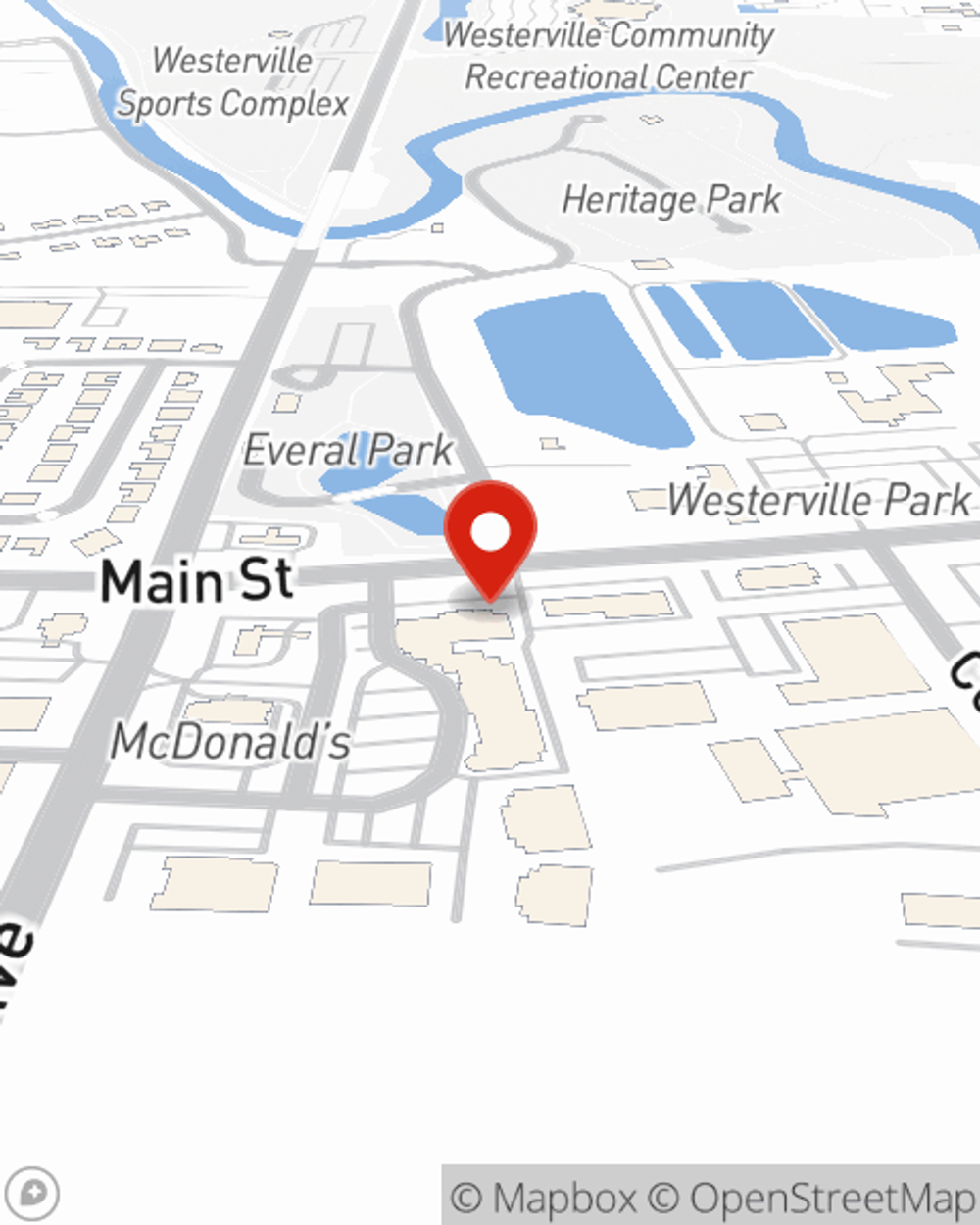

Business Insurance in and around Westerville

One of Westerville’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insure The Business You've Built.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes mishaps like a customer hurting themselves can happen on your business's property.

One of Westerville’s top choices for small business insurance.

Almost 100 years of helping small businesses

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Debbie Montgomery is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Debbie Montgomery can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let fears about your business stress you out! Get in touch with State Farm agent Debbie Montgomery today, and explore the advantages of State Farm small business insurance.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Debbie Montgomery

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.