Renters Insurance in and around Westerville

Get renters insurance in Westerville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or apartment, renters insurance can be the right decision to protect your stuff, including your coffee maker, golf clubs, tablet, hiking shoes, and more.

Get renters insurance in Westerville

Your belongings say p-lease and thank you to renters insurance

Why Renters In Westerville Choose State Farm

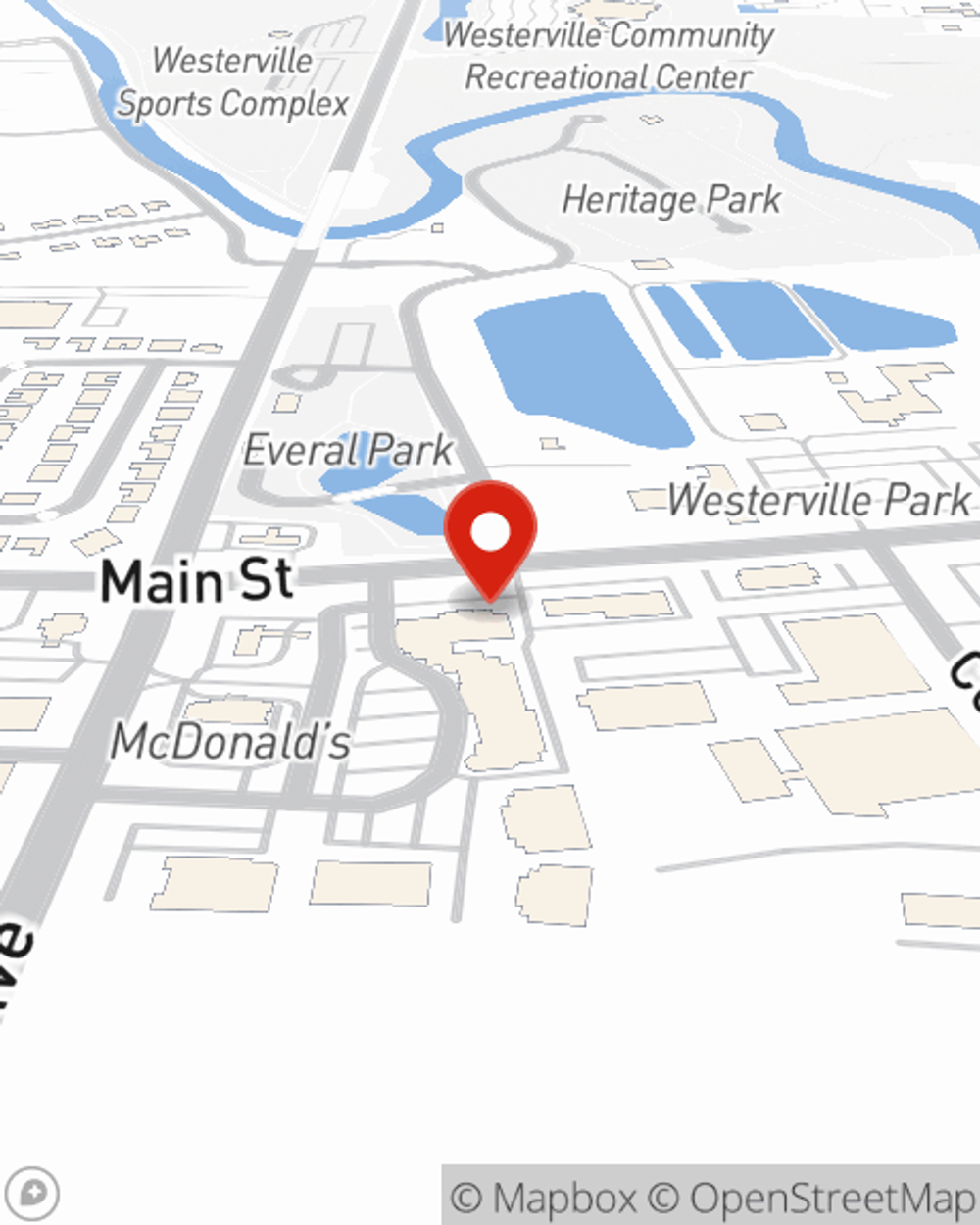

Renting is the smart choice for lots of people in Westerville. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance could cover the cost of tornado damage to the roof or water damage to walls and floors, what about the things you own? Finding the right coverage helps your Westerville rental be a sweet place to be. State Farm has coverage options to match your specific needs. Luckily you won’t have to figure that out alone. With personal attention and reliable customer service, Agent Debbie Montgomery can walk you through every step to help you set you up with a plan that protects the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Westerville renters, are you ready to discover the benefits of a State Farm renters policy? Call or email State Farm Agent Debbie Montgomery today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Debbie at (614) 890-2886 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Debbie Montgomery

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.